34+ income to debt ratio for mortgage

Web An individual currently pays 2000 a month for their mortgage 100 for car insurance and 500 in other debts. Web Total debt502000 The following formula would then be applied.

Debt To Income Ratio For Mortgage Definition And Examples

If the monthly gross income of this individual is.

. Web In general borrowers should have a total monthly debt-to-income ratio of 43 or less to be eligible to be purchased guaranteed or insured by the VA USDA. If your home is highly energy-efficient. Web Here are debt-to-income requirements by loan type.

A proposed mortgage of 780 per month Credit card minimum payment of 100 so monthly debt of 150 Car lease total 305 per month Overdraft of 1000 interest and fees approx. Web DTI measures your debts as a percentage of your income. The person in this.

Youll usually need a back-end DTI ratio of 43 or less. 28 of your income will go to your mortgage payment and 36 to all your other household debt. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Youll see there are slots for. 900 3000 03.

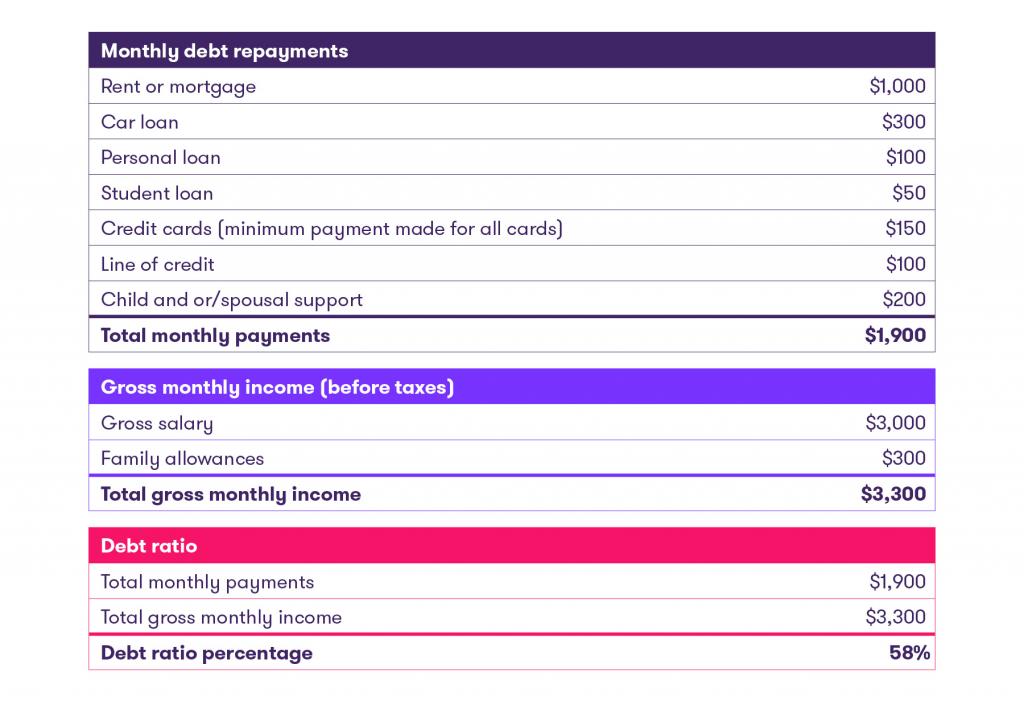

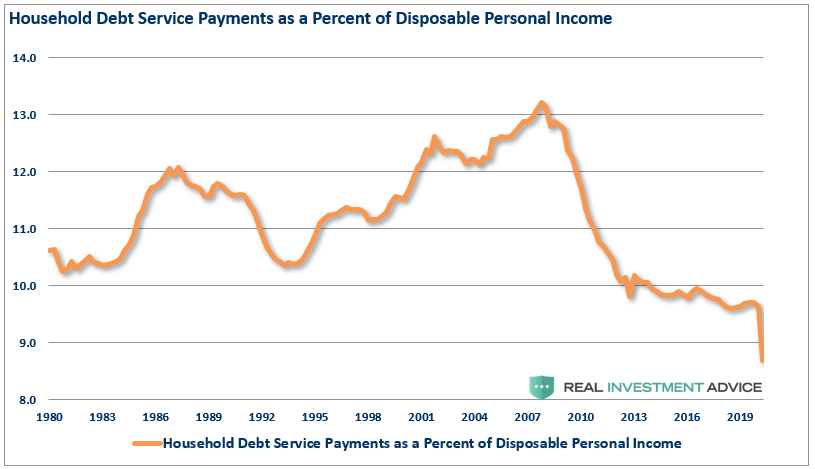

Web While debt growth slowed and income increased the debt-service ratio continued to edge higher and debt repayment slowed TD Economics Ksenia. 1 2 For example. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For.

Web Monthly income before taxes How to do a debt-to-income ratio check Step 1 Enter all your personal loan expenses into our calculator. Web 43 to 50. Web The 2836 rule is an addendum to the 28 rule.

502000 160000 314 DTI What this means is that your total debt is 314 timesyour. Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Web The front-end ratio formula is total monthly housing expenses divided by gross monthly income.

Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100. Multiply that by 100 to get a. 03 x 100 30 or 30.

A higher ratio could mean youll pay more. Web Understanding Debt-to-Income Ratio for a Mortgage A good DTI ratio to get approved for a mortgage is under 36. Ratios falling in this range often show lenders that you have a lot of debt and may not be ready to take on a mortgage loan.

Your monthly expenses include 1200. You have a pretax income of 4500 per month. Web Debt to income DTI ratio examples Example one.

Debt To Income Ratio Calculator What Is My Dti Zillow

How To Calculate Your Debt To Income Ratio For A Mortgage

Debt To Income Ratio Calculator 1 0 Windows Download

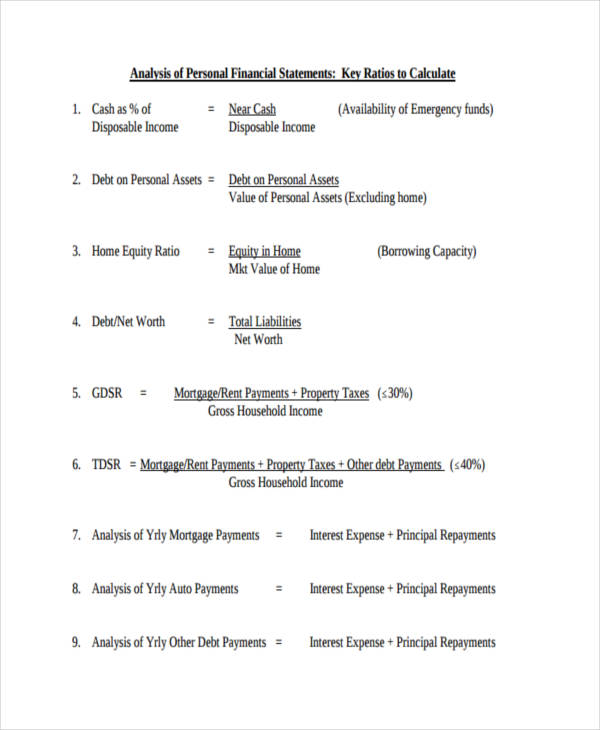

Financial Analysis 34 Examples Format Pdf Examples

Calculating And Understanding My Debt Ratio Raymond Chabot

How To Calculate Your Debt To Income Ratio For A Mortgage

Debt To Income Ratio Calculator How To Calculate Your Ratio

Debt To Income Ratio Crb Kenya

List Of Top Personal Loan Providers In Silvassa Vapi Road Vapi H O Best Personal Loans Online Justdial

Pdf Low Income Students Human Development And Higher Education In South Africa

Why Debt To Income Ratios Are Worse Than They Appear Seeking Alpha

Debt Ratio And Debt To Income Ratio

Debt To Income Ratio To Be Able To Qualify For A Mortgage

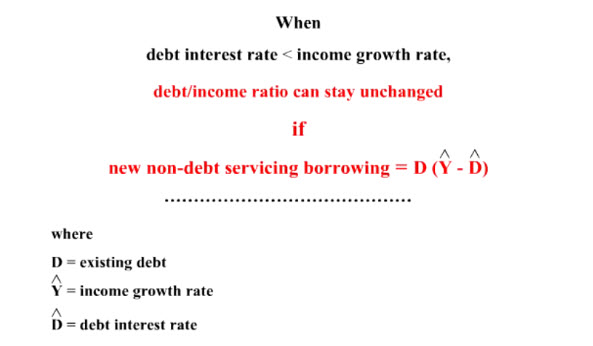

Living Economics Deficit And Debt Transcript

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

How To Calculate Your Debt To Income Ratio Rocket Money

Debt To Income Ratio Calculator Nerdwallet